Contingencies in Real Estate: Pros & Cons, Common Types, And Whether You Need Them

Contingencies in a residential purchase contract in the state of California are contractual clauses that allow the buyer (or seller in the case of seller contingencies) the right right to cancel a contract if the terms of the clause are not met, without the potential of forfeiting your earnest money deposit. While contingencies can be built into a contract for pretty much anything you can think of, there’s a few common and somewhat standard contingencies for buyers:

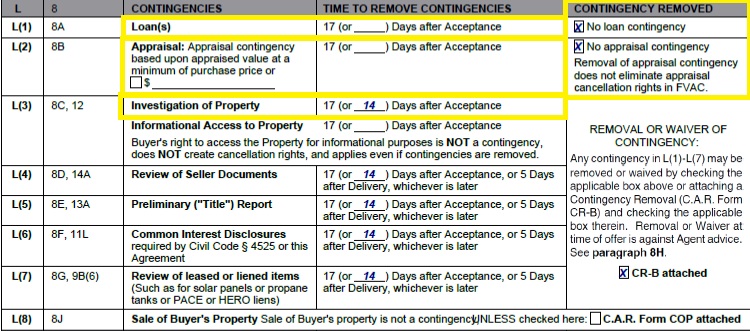

- Investigation contingencies

- Appraisal contingencies

- Loan contingencies

In this article, we’ll dive into each of these three most common contingencies, why you may or may not want to include them in your offer, and other considerations.

Whether you’re looking to buy, sell, or invest in real estate, it’s worth taking the time to properly understand these contingencies not only to mitigate risk, but also to create the strongest offer possible and thus increase your chances of getting the deal.

Investigation Contingencies

An investigation contingency, often called an inspection contingency, allows buyers to cancel a purchase contract for any discovery related to the condition of the home or any other matter affecting the property, within the contingency period .

The term “matters affecting the property” is meant to be vague and covers a wide range of things buyers may care about, including but not limited to…

- Home and Pest Inspection findings

- Home Insurance availability

- Volume of traffic on the street

- Noise from nearby avalanche control or planes

- Shade cast by a nearby pine tree

- And many other reasons

The investigation contingency is often used to cancel the contract for any reason, especially when buyers get cold feet. Because of this, investigation contingencies can be a bit of a sticking point with sellers, especially in competitive markets like Lake Tahoe and Truckee.

Keep in mind: if a seller were to receive two identical offers – one with an investigation contingency and one without – the seller would almost definitely choose the offer without the investigation contingency, to increase the chances that the deal will close without further negotiation or required repairs.

As a buyer, this is something you should keep in mind as you work with your agent to prepare competitive offers.

Appraisal Contingencies

If you’re obtaining a loan to purchase your home, your lender will most likely order an appraisal of the property to verify that the house/property is worth at least as much as the purchase contract.

The appraiser – an independent party from the lender – is hired to form an unbiased opinion of value through sales data, making appropriate adjustments for the homes location, quality, age, condition, lot size, and amenities. Appraisers also consider the replacement cost of a property and if appropriate, the income approach to value which evaluates rents, income and expenses.

The appraisal contingency is utilized to protect the buyer in case the appraiser’s opinion of value is lower than the contractual purchase price. If this happens, you may cancel the deal, attempt to renegotiate the price, or decide to cover the gap between the appraised value and the purchase price.

If you don’t have an appraisal contingency in place and the property appraises below the offer price, you are contractually required to make up the difference between appraised value and purchase price with additional cash, find other financing solutions, or potentially cancel the contract – putting your earnest money deposit at risk.

Loan/Financing Contingencies

The loan contingency is in place to make sure that you are able to qualify for a loan at the terms specified in the contract. During the contingency period, if you discover that you can’t qualify for a loan, you can cancel the contract at no penalty. Even if you have been pre-qualified for a loan, you could still be turned down for a loan if your debt to income ratio is outside of the lender guidelines. Your loan could be at risk if you lose your job prior to closing or if you make and/or finance a major purchase (car, boat, etc.) during the escrow which could have a negative affect on your debt to income ratio.

Depending on your own specific financial picture, it may be possible/reasonable to submit offers with no financing contingency with very low risk to you, which essentially makes you competitive with cash buyers. It’s important to speak with your lender about the risks associated with your specific situation, as they have the most complete understanding of your own financial picture. Your Realtor should never make this decision for you, even though it could help improve your offer.

Should You Waive Contingencies?

In a “hot market” or in multiple offer situations, contingencies are often waived to better compete against other buyers. While this may be necessary to get your offer accepted, it may often be against the advice of your real estate agent as you are removing protections that safeguard your earnest money deposit.

Canceling a contract without the protection of an applicable contingency can put your earnest money deposit at risk, which can amount to a loss of tens of thousands of dollars, or more in bigger transactions.

On the other hand, writing an offer that includes contingencies may make your offer less competitive/attractive in the eyes of the seller, especially in a multiple-offer situation.

Speak with your agent about the risk and potential rewards of waiving contingencies prior to submitting offers.

Which Contingencies Do You Need?

Now that you’re familiar with the three most common types of contingencies, as well as the pros and cons of including these protections in your offer, which contingencies should you have in place?

The answer to that depends on the property, the competition, your confidence, and your situation. Typically, buyers want to have as many contingencies in place for as long as possible for their protection, while sellers want as few contingencies as possible for as short a period of time as possible.

Talk with your agent about writing an offer that provides you with the protections you need, while staying competitive against other offers.

Have Questions? Contact Dave Westall & Beth Taylor

Dave Westall & Beth Taylor are your Lake Tahoe Real Estate experts and are happy to answer any questions you have about purchasing or selling luxury homes in Truckee and North Lake Tahoe.