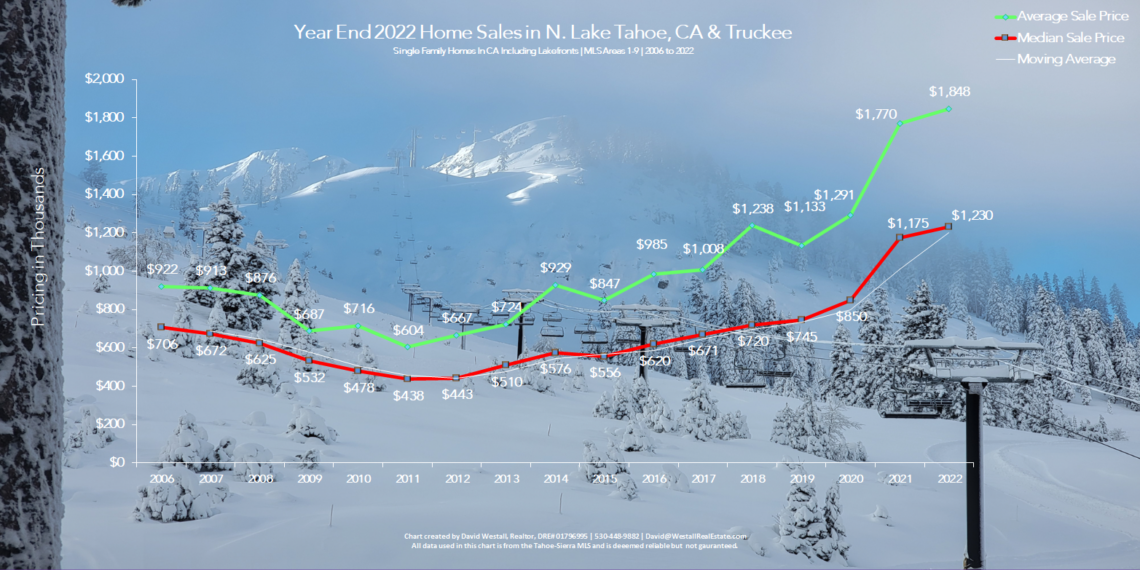

Despite Challenging Market Conditions, The Median Home Price in Lake Tahoe Was Up 5% In 2022

The North Lake Tahoe, CA real estate market started 2022 as an aggressive continuation of 2021 with above-average demand and limited housing inventory, resulting in a frothy real estate market with short marketing times and most homes selling with multiple offers and above asking price. That all ended in the second half of 2022 as pandemic-era inflation led to the Fed aggressively raising interest rates, which caused mortgage interest rates to rise rapidly.

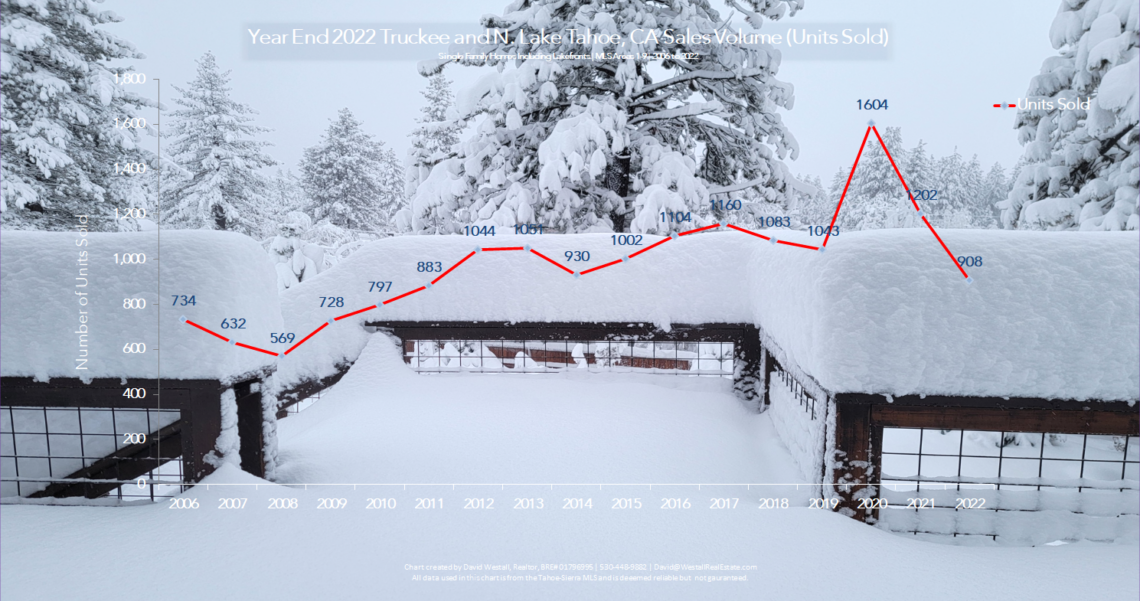

By mid-year, capitulation had set into equity markets, and with increased talks of an impending recession, fear, uncertainty, and doubt (FUD) filled the minds of consumers. The second half of 2022 was defined by a limited number of buyer participants, shackled inventory, and rising mortgage rates, resulting in the lowest number of single-family home sales in over a decade.

53% of Lake Tahoe Home Sales in 2022 Were Priced Over $1M

In 2022, 53% of all Lake Tahoe home sales were priced over $1M, the second highest luxury home sales ratio that the Tahoe real estate market has ever seen. The highest-priced sale of the year was a West Shore Tahoe lakefront estate which sold for $41,259,400, bolstering the average home price for 2022 as this sale was 24% above the $33M high sale of 2021. Martis Camp, Truckee’s premier gated golf course community, produced 32 home sales with an average price of $8.5M, up 19% over 2021. Although the volume of luxury home sales was off 18%, the luxury market segment helped propel Tahoe home prices to record levels.

“Despite a national cooling in residential real estate, we’re finding that the luxury real estate market is still in a league of its own. We’ve continued to see luxury sales volume growth in many top destination communities across the U.S. It’s just not the whiplash-inducing lightning-speed growth we saw throughout much of 2020 and 2021. High-net-worth buyers are not as reliant on financing, so they might be less deterred by rising rates, and we hear a lot from our buyers that they don’t want to wait for perfect market conditions, they are ready to enjoy the benefits of a second home now.” —Pacaso CEO Austin Allison

Lake Tahoe Real Estate Market is up 65% Since 2019 (pre-pandemic)

Since 2019 (pre-pandemic), the median home price is up an astounding 65%, and although the volume of transactions is off from the record stats of 2021, the market remains on solid footing. My analysis shows that the Tahoe real estate market is not falling apart. Instead, the velocity of the market has slowed significantly, but demand continues to outpace supply which has kept upward pressure on pricing as evidenced by the 5% increase in the median home price.

Lake Tahoe Seller’s Are Not Motivated

Most Lake Tahoe homeowners have significant equity and enjoy their home’s utility. If an owner has a loan, it is typically a smaller loan at a favorable interest rate. For these reasons, sellers are not motivated to sell and are happy to enjoy their vacation homes until market conditions improve. Convincing owners to part with their properties has become increasingly challenging over the last few years, which has helped stabilize the Tahoe market.

Year over Year Market Conditions and Value Trends

2022 Statistics

- 908 Single-Family Home Sales Down 24%

- Marketing Time: 34 Days Up 21%

- List to Sold Ratio: 94% Down 8%

- Total Sales Volume: $1.68B Down 21%

- Average Price: $1.85M Up 4%

- Median Price: $1.23M Up 5%

- 1 REO & Short Sales Even

- 10 Sale Below $500K Down 58%

- 594 Sales over $1M Down 18%

- 106 Sales over $3M Down 20%

- High Sale Price: $41M Up 24%

- Low Sale Price: $230K Down 16%

2021 Statistics

- 1,202 Single-Family Home Sales

- Marketing Time: 28 Days

- List to Sold Ratio: 102%

- Total Sales Volume: $2.13B

- Average Price: $1.77M

- Median Price: $1.18M

- 1 REO & Short Sales

- 24 Sales Below $500K

- 724 Sales over $1M

- 133 Sales over $3M

- High Sale Price: $33M

- Low Sale Price: $275K

Lake Tahoe Real Estate Year End 2022 Market Report Sales Chart

Lake Tahoe Real Estate Year End 2022 Sales Volume Chart

*North Lake Tahoe, CA and Truckee Single-Family Home sales including lakefronts. Data is taken from the Tahoe-Sierra Board of Realtors, MLS Areas 1-9.

Absorption Rate: 2.1 Months of Inventory = Seller’s Market

The term absorption rate refers to a metric used in a specific real estate market to evaluate the rate at which available homes are sold during a given period of time. Here are the metrics and absorption rate for the North Lake Tahoe, CA and Truckee real estate market.

Absorption Rate (single-family homes)

- 908 Sales in the Last 12 Months

- 75.66 Sales per Month

- 2.5 Sales Per Day

- 157 Current Active Listings

- 157 Listings / 75.66 Sales Per Month = 2.1 Months of Inventory = Seller’s Market

- 1 to 3 Month Supply of Inventory = Seller’s Market

- 4- 6 Months of Inventory = Balanced Market

- 6+ Months of Inventory = Buyer’s Market

Currently, there are 68 pending homes in escrow with an average list price of $1.8M and a median price of $1.1, which shows minor softening from September to October. This could be related to the sever lack of inventory, seasonal market shifts, or it could be the start of a trend. We will have to see what happens in November for confirmation and further analysis.

The Absorption Rate Improved in Q4 2022

Currently, there are 40 pending homes in escrow with an average list price of $1.76M and a median price of $1.1M. This shows minor softening from the year’s first half but is still on par with 2021 and above the stats of 2020.

With only 2.1 months of inventory (homes for sale), the advantage has shifted from market stabilization to a slight lean to the seller’s advantage. Although the number of active buyers in the market is down year over year, housing inventory is highly constrained, so home pricing remains relatively stable. In a more typical market, we would be in a strong seller’s market with 2.1 months of inventory. In the current market that is plagued by fear, uncertainty, and doubt, having less than 3 months of inventory has characteristics resembling a more stabilized market.

The Current Market Provides Opportunity for Buyers and Sellers Alike

The best-priced homes are moving quickly, while other listings tend to linger on the market, often requiring price reductions and deeper negotiations to get a sale done. Buyers remain excited about newer homes, updated homes, and properties located within desirable communities. Inversely, older/dated homes with differed maintenance issues are taking longer to sell. The market is timid when purchasing homes that need significant improvements, even if priced well within the market segment.

The dramatic market conditions of the “COVID Years” have subsided. We have entered a new chapter where fewer buyers exist in the market, housing inventory is constrained, and home prices have stabilized. Although the Tahoe real estate market has slowed, it remains on sound footing, creating opportunities for buyers and sellers alike.

Lake Tahoe Real Estate Market Report Archive

View All Tahoe Real Estate Market Reports

Year-End 2021 Real Estate Market Report

Year-End 2020 Real Estate Market Report

Contact Dave Westall – Lake Tahoe Real Estate Agent

As the premier Tahoe Realtor, I’m here to help, provide insight, and help you achieve your real estate goals. Let’s schedule a Zoom meeting to chat and discuss how I can be of assistance.

For Lake Tahoe real estate news, property listings, and events Sign up for our Newsletter.

WANT TO KNOW THE VALUE OF YOUR LAKE TAHOE HOME?

Leave a Reply

You must be logged in to post a comment.