Home Sales are Outpacing New Listings in N. Lake Tahoe, CA

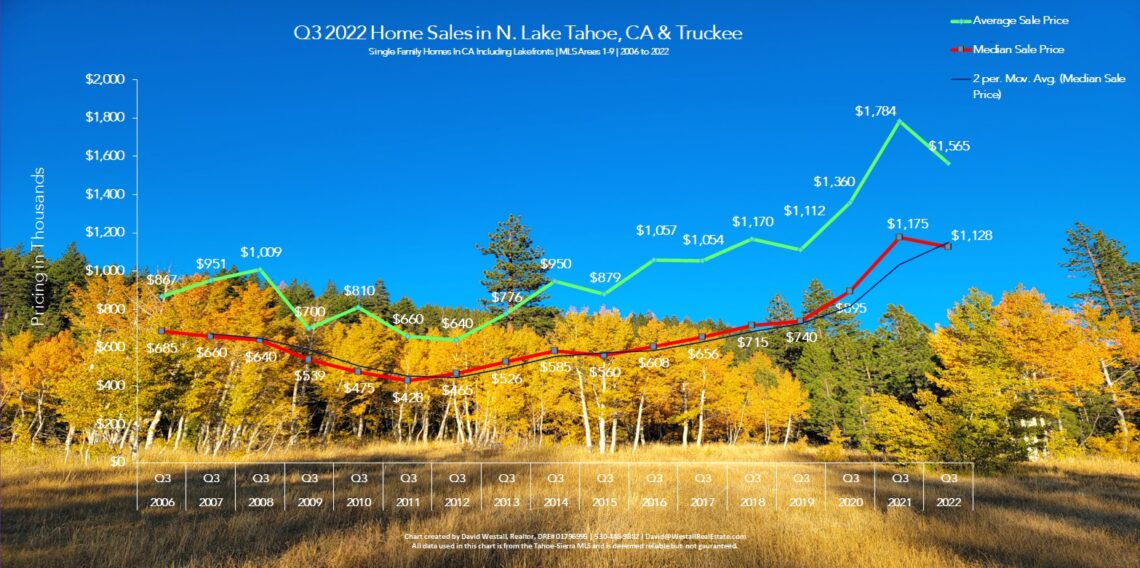

The North Lake Tahoe, CA real estate market has seen a significant slowdown since peak market pricing in Q3 of 2021. With that noted, pricing remains on an upward trajectory in Q3, and currently, sales volume is outpacing the number of new listings. With recent sales outpacing listing volume, the Tahoe market is showing its strength. In the sales chart below, I added a moving average trendline to the median home price, which shows consistent appreciation in the market since 2012.

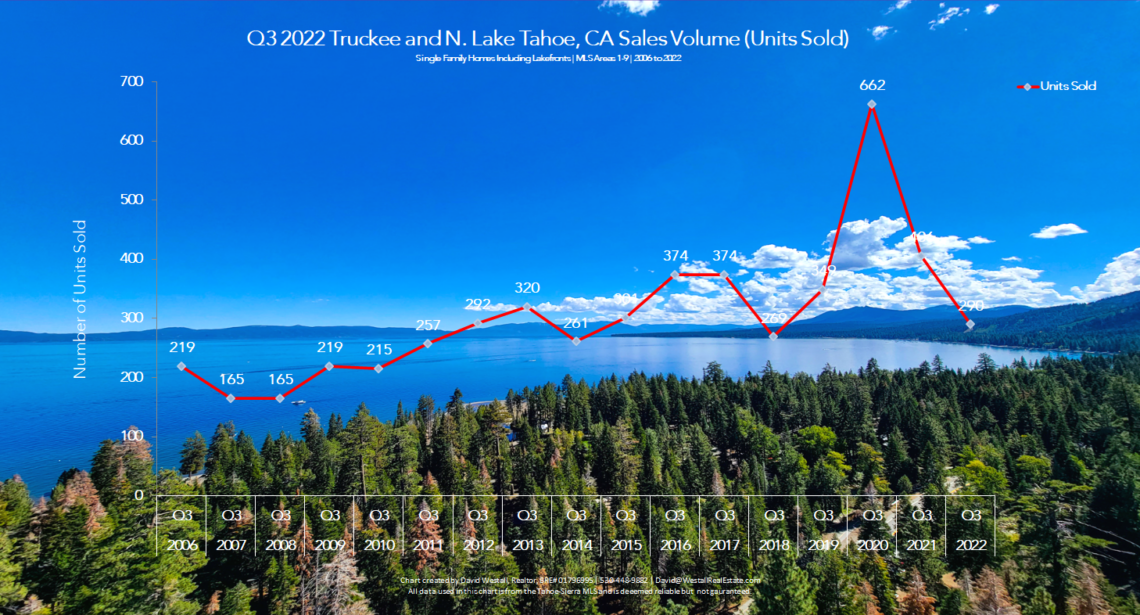

Since 2019 (pre-pandemic), the median home price is up 52%, and although we are off from the record market stats of 2021, the market remains on solid footing. My analysis shows that the market is not falling apart. Instead, the velocity of the market has slowed, but demand is outpacing supply which has kept upward pressure on pricing.

Seller Motivation at an All-Time Low

A majority of Lake Tahoe sellers have significant equity and enjoy the utility their vacation homes provide. If an owner has a loan, it is typically a smaller loan and at a favorable interest rate. For these reasons, sellers are not motivated to sell and are happy to enjoy their vacation homes until market conditions improve. Getting sellers to part with their properties has become increasingly challenging over the last few years, which has added to the market’s resilience.

Where is the Housing Inventory?

Most Tahoe neighborhoods suffer from a historic lack of inventory. New listings get a lot of attention, especially well-cared-for homes in desirable neighborhoods. Updated and new construction homes are seeing strong buyer activity, and some of these properties are still receiving multiple offers when priced correctly. Buyers are discerning in the current market, so pricing a house correctly is more crucial than ever. We have entered the portion of the Tahoe sales cycle where inventory levels drop going into winter and do not pick up until the spring. With demand already exceeding supply, I anticipate that there will be increased pent up demand going into the spring of 2023, which will help continue to put upward pressure on home prices. With mortgage interest rates hovering between 6.5% and 7% with now help in sight and demand for Tahoe properties exceeding inventory, this appears to be a good time to buy Tahoe real estate.

Year over Year Market Conditions and Value Trends

Q3 2022 Statistics

- 290 Single Family Home Sales Down 29%

- Marketing Time: 27 Days Up 35%

- List to Sold Ratio: 98% Down 5%

- Total Sales Volume: $454M Down 37%

- Average Price: $1.57M Down 12%

- Median Price: $1.13M Down 4%

- 0 REO & Short Sales Even

- 2 Sale Below $500K Down 50%

- 177 Sales over $1M Down 26%

- 24 Sales over $3M Down 45%

- High Sale Price: $9M Down 27%

- Low Sale Price: $380K Down 5%

Q3 2021 Statistics

- 406 Single Family Home Sales

- Marketing Time: 20 Days

- List to Sold Ratio: 103%

- Total Sales Volume: $724M

- Average Price: $1.8M

- Median Price: $1.18M

- 0 REO & Short Sales

- 4 Sales Below $500K

- 239 Sales over $1M

- 44 Sales over $3M

- High Sale Price: $12.25M

- Low Sale Price: $400K

Lake Tahoe Real Estate Q3 2022 Market Report Sales Chart

Lake Tahoe Real Estate Q3 2022 Sales Volume Chart

*North Lake Tahoe, CA and Truckee Single-Family Home sales including lakefronts. Data is taken from the Tahoe-Sierra Board of Realtors, MLS Areas 1-9.

Absorption Rate: 2.51 Months of Inventory = Seller’s Market

The term absorption rate refers to a metric used in a specific real estate market to evaluate the rate at which available homes are sold during a given period of time. Here are the metrics and absorption rate for the North Lake Tahoe, CA and Truckee real estate market.

Absorption Rate (single-family homes)

- 602 Sales in the Last 6 Months

- 100 Sales per Month

- 3.34 Sales Per Day

- 251 Current Active Listings

- 251 Listings / 100 Sales Per Month = 2.51 Months of Inventory = Seller’s Market

- 1 to 3 Month Supply of Inventory = Seller’s Market

- 4- 6 Months of Inventory = Balanced Market

- 6+ Months of Inventory = Buyer’s Market

Currently, there are 87 pending homes in escrow with an average list price of $1.9M and a median price of $1.19M, which is an uptick in pricing from August and shows that Tahoe home pricing remains on sound footing. With only 2.5 months of inventory (homes for sale), the advantage has shifted from market stabilization to a slight lean to the seller’s advantage. Although the number of buyers in the market is down year over year, housing inventory is highly constrained, so home pricing remains stable.

The Absorption Rate Improved in September

Tahoe real estate inventory levels appear to have peaked in August, and it seems that there will be fewer listings on the market in the remaining months of 2022 (typical sales cycle). Over the last 30 days, the absorption of Tahoe housing inventory has increased by .74%, which means that homes are selling faster in August than in July. If this momentum sticks and fewer homes come on the market in Q4, then demand will outpace supply heading into the winter, which is typically a constrained inventory time period, helping to further stabilize the market.

The Current Market Provides Opportunity for Buyers and Sellers Alike

The 3rd quarter saw fewer sales taking place due to lower buyer demand, yet inventory levels remain historically low, which has led to stabilized market conditions with a lean towards the sellers. Buyers remain excited about newer homes, updated homes, and properties located within desirable communities. Inversely, older/dated homes with differed maintenance issues are taking longer to sell as the market is timid when purchasing homes that need significant improvements, even if priced well within the market segment. The best-priced homes are moving quickly, while other listings tend to linger on the market, often requiring price reductions.

Inventory levels peaked in August, and it seems that there will be fewer listings on the market in the remaining months of 2022. Over the last 30 days, the absorption of Tahoe housing inventory has increased by .74%, which means that homes are selling faster in September than in August and July. If this momentum sticks and fewer homes come on the market in Q4, then demand will outpace supply heading into the winter, which is typically a constrained inventory time period, helping to further stabilize the market.

Lake Tahoe Real Estate Market Report Archive

View All Tahoe Real Estate Market Reports

Q3 2021 Real Estate Market Report

Q3 2020 Real Estate Market Report

Contact Dave Westall – Lake Tahoe Real Estate Agent

As the premier Tahoe Realtor, I’m here to help, provide insight, and help you achieve your real estate goals. Let’s schedule a Zoom meeting to chat and discuss how I can be of assistance.

For Lake Tahoe real estate news, property listings, and events Sign up for our Newsletter.

Leave a Reply

You must be logged in to post a comment.